THE KERALA LABOUR WELFARE FUND RULES, 1977*

- Short title and Extent.- These rules may be called the Kerala Labour welfare Fund Rules, 1977.

- Definitions.- In these rules, unless the context otherwise requires.-

- “Act” means the Kerala Labour Welfare Fund Act, 1975(II of 1977)

- “Form” means a form appended to these rules;

- “Section” means a section of the Act.

- Payment of Fines and unpaid Accumulations by Employers.-

- Within fifteen days from the date on which the Act comes into force, every employer shall pay by cheque, money order or cash to the Commissioner.- (a) All fines including the amounts realised under Standing Order 20 of the Model Standing Orders issued under the Kerala Industrial Employment (Standing Orders) Rules, 1947, from the employees before the said date and remaining unutilized on that date; (b) all deductions made under the proviso to sub-section (2) of Section 9 of the Payment of Wages Act, 1936 (Central Act 4 of 1936), from the wages of employees before the said date and remaining unutilised on that date; and (c) all unpaid accumulations held by the employer on the aforesaid date.

- The employer shall, along with such payment, submit a statement to the Commissioner giving full particulars of the amount so paid.

- All the fines realised and deductions made from the wages of the employees and all unpaid accumulations held on or after the date on which the Act comes into force, shall be remitted half-yearly to the Commissioner along with the half-yearly contributions payable by the employer and employees under section 15.

*pub.in K.G.Ext.No.265 dt.01-05-1977 G.O.M.S No.26/77/LBR,dt.Tvm,. Ist May 1977 as SRO 372/77.

- Particulars of unpaid Accumulations to be Published under Section13.- The notice

referred to in sub-section (3) of Section 13 shall contain the following particulars,

namely.-

(i) name and address of the establishment in which the unpaid accumulation was earned ;

(ii) wage period during which the unpaid accumulation was earned;

(iii) names of employees with amount of unpaid accumulation in respect of each employee; and the total amount of the accumulation; and

(iv) a declaration that a list containing the names of employees and the amount due to them and paid to the Board has been put on the notice board of the factory or establishment in which the unpaid accumulation was earned. - Notice for Payment of fine and unpaid Accumulations.- The Commissioner may after making such enquiries as he may deem fit and after calling for a report from the Inspector, if necessary, serve a notice as required by Section 14 on any employer to pay the amount of fines realised or unpaid accumulation held by him which the employer has not paid in accordance with Rule 3.

- Remission of Penalty.-

(1) Application for remission of penalty payable under sub- section(2) of Section 14 shall be made to the Government within thirty days from the date of payment of penalty and shall clearly specify the grounds on which remission is claimed.

(2) When the Government is satisfied that such penalty is likely to cause undue hardship the employer concerned or that the employer has suffered financially on account of riots war, or through natural calamities or that delay caused in the payment of unpaid accumulations or fines was due to circumstances beyond his control, the Government may remit such penalty in part or whole. - Maintenance and Audit of Accounts.- The accounts of the fund shall be prepared and maintained by the Finance Officer of the Board in such manner and forms as may be prescribed by the Board and shall be got audited as provided in sub-rule(3). (2) The Commissioner shall be responsible for the disposal of audit note. (3) The Accounts of the Fund shall be audited in accordance with the instructions issued by the Government. (4) The charges on account of audit shall be paid out of the Administration Account.

- Budget of the Board.-

(1) The Budget estimates for each financial year shall be prepared and laid before the Board on or before the 1 st December of the previous financial year and after it is approved by the Board, shall be forwarded to the Government for approval on or before the 15 th December. (2) The Government shall approve the Budget before 15 th of January after making such amendments and alterations, if any, as they consider necessary.

(3) The Budget as approved by the Government with or without amendments or alterations shall constitute the Budget of the Board for the ensuring financial year and shall be issued under the seal of the Board and signed by the Officer or Officers of the Board duly authorised by it in this behalf.

(4) Two authenticated copies of the Budget shall be forwarded to the Government before the 28 th February. - Additional Expenditure.- (1) If during the course of a financial year it becomes necessary to incur expenditure over and above the provisions made in the budget, the Board shall immediately submit to the Government the details of the proposal expenditure and specify the manner in which it is proposed to meet the additional expenditure and thereupon the Government may either approve the proposed expenditure after making such modifications as they consider necessary or reject it. (2) A copy of the order passed by the Government on every such proposed to incur additional expenditure shall be communicated to the Board.

- Mode of Payment.- All payment from the Fund amounting to:-

(a) less than Rs.50 may be made in cash or money order,

(b) Rs.50 or more shall be made in cheque issued by the Commissioner; Provided that the Board may, in any particular case, for special reasons; authorize such payment also in cash. - Payment of Contribution.-

(1) Every employer shall recover from every employee whose name is borne on the register of his establishment on the 30 th June, or 31 st December of each year, the employee’s contribution from his Wages other than the wages for the month of June or December, as the case may be, of that year: Provided that no such deduction shall be made in excess of the amount of the contribution payable by such employee, nor shall it be made from any wages for the months of June and December: Provided further that if by inadvertence or otherwise no deduction has been made from the wages of an employees for the months aforesaid, such deduction may be made from the wages of such employee for any subsequent month or months with the permission in writing of the Inspector.

(2) Notwithstanding any contract to the contrary, no employer shall deduct the employers contribution from any wages payable to the employee or otherwise recover it form the employees. (3) An employer shall pay the employer’s and employee’s contributions to the Board by cheque, money order or in cash, and he shall bear the expenses of remitting to the Board such contributions.

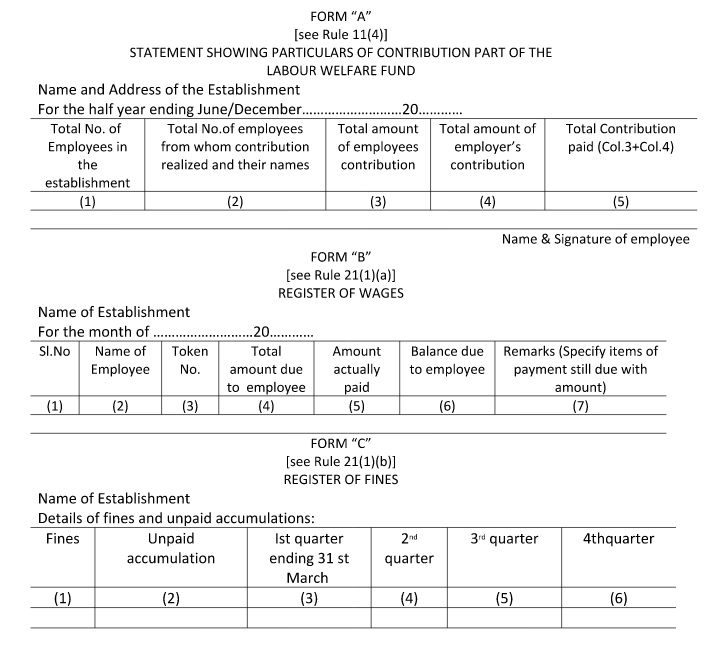

(4) The employer shall along with such payment submit a statement in Form “A” to the Commissioner giving full particulars of the amount so paid 1 [along with the names of employees on whose behalf the payment was made.] - Constitution of Board.- The Board shall consist of the following 21 members

appointed by the Government.-

(a) Five representatives of employers;

(b) Five representatives of employees;

(c) Five Government officials; and

(d) Six non-officials;

Provided that the Government may appoint one or more additional person to be members of the Board, so, however, that the total number of members does not exceed 25. - Allowance of members.- The members of the Board other than Government officers shall be entitled to travelling allowance and daily allowance at the rate applicable to 1 st Grade Officers of the Government; provided however that travelling allowance for journeys performed shall be limited to journeys performed form the place residence with in the State.

- Meeting of the Board.-

(1) The Board shall meet at least once in every quarter and as often as may be necessary.

(2) The Commissioner shall, in consultation with the Chairman, fix the date, time and place of meeting and also draw up the agenda for every meeting.

(3) Notice of not less than seven clear days shall be given for every such meeting and no matter, other than that included in the agenda, shall be considered except with the permission of the Chairman. Provided that, seven days clear notice shall not be necessary when, in the opinion of the Chairman, business of an urgent nature has to be transacted. - Power of the Board to Borrow Money.- Subject to the prior approval of the

Government, the Board may, from time to time borrow any such of money and

secure repayment of such sum in such manner and upon such terms and conditions

as they think fit.

1. The words added by SRO No.947/2007 (w.e.f. 3-9-2004)

- Conditions of Appointment and Service and scale of Pay of the Commissioner.- The

Commissioner shall be an officer of the Labour Department not below the rank of

Joint Labour Commissioner appointed on deputation on usual terms and conditions

applicable to government servants of deputation.

(2) The scale of pay of the Commissioner shall be Rs.1150-50-1450-50/2-1650.

- Appointment, Duties and Powers and conditions of Appointment and Service of

Finance Officer.-

(1) The Finance Officer shall be an officer of the Government in the Finance Department not below the rank of Under Secretary or an Officer in the Accountant General’s Office not below the rank of Accounts Officer appointed on deputation basis on the usual terms and conditions applicable to Government servants on deputation.

(2) the scale of pay of the Finance Officer shall be Rs.950-50-1350-50/2-1450.

(3) The duties of the Finance Officer shall be the following.-

- (a) preparation of budget estimates;

- (b) distribution of allotments among the Subordinate, Controlling Officers;

- (c) reconciliation of Board’s account with the figures booked in the Accountant General’s office;

- (d) control over Board revenue and expenditure which includes;

(i) watching the progress of Board’s revenue and expenditure and issuing instructions to the subordinate officers to keep the expenditure and issuing instructions to the subordinate officers to keep the expenditure within allotments when any likelihood of excess is anticipated;

(ii) reporting to the Board deviations from rules relating to expenditure noticed on the part of the Subordinate Officers;

(iii) initiating add dealing with proposals relating to reappropriation, reallotments, supplementary grants and surrender of Savings;

(iv) Scrutinizing expenditure statement relating to various programs of the Board.

- (e) Scrutiny of all cases involving,- (i) abandonment of Revenue; (ii) refund of Revenue; (iii) enhancement of Revenue; and (iv) write off of Board’s dues and liabilities;

- (f) scrutiny of all proposals involving financial commitment submitted by the Board to Government;

- (g) review of progress in the disposal of audit objection and dealing with audit inspection reports.

- (h) Internal audit of the accounts of the head office;

- (i) Inspection of the accounts of subordinate officers under the orders of the Commissioner and submission of notes of such inspection for his perusal and orders;

- (j) Verification of claims for pension or gratuity;

- (k) issue of instructions to Board’s officers regarding (i) maintenance of accounts and observance of accounts rules, and (ii) correct accounting of stores and observance of Store Rules;

- (l) to arrange for the proper maintenance of accounts relating loans sanctioned and/or disbursed by the Board and to watch the prompt recovery of such loans;

- (m) to test audit of account of institutions which receive grants –in-aid or loans from the Board and to furnish utilization certificates wherever required ;

- (n) to advise the Board on all matters relating to Finance accounts and application of Code Rules; and

- (o) any other duties and functions assigned by the Board.

(4) Subject to overall control and supervision of the Commissioner the Finance officer shall be competent.-

- (a) to carry on correspondence with the subordinate officers on all accounts and financial matters an the disposal of objections and audit inspection reports;

- (b) to sign fair copies of communications to Government relating to Finance and Accounts, the drafts of which have been approved by the Commissioner;

- (c) to send communications to the Accountant General furnishing information relating to Finance and Accounts;

- (d) to sanction casual leave to the staff working under him; and

- (e) to call for explanations from the staff working under him for dereliction

-

Qualifications and Powers of Inspectors.-

(1) No person shall be appointed Inspector unless he,-

(a) is a graduate and (b) possesses a postgraduate degreeor diploma in Social Welfare or equivalent qualification.

2 [Provided that the qualifications specified above shall not be insisted upon in the case of officers of the Labour Department not below the rank of Assistant Labour Officer Grade II].

(2) In addition to the powers conferred by sub-section (2) of Section 24, an Inspector shall, for the purpose of giving effect to the provisions of the Act, have power.-

(i) Subject to the provisions of sub-section (1) of Section 29 to prosecute, conduct or defend before court any complaint or other proceeding arising under the Act;

(ii) to require any employer to supply or send any return or true copy of any document or information relating to the provisions of the Act;

(iii) to satisfy himself at each inspection that.- (a) The provisions of the Act and the rules regarding the payment of contribution and unpaid accumulation and fines are complied with; (b) the prescribed registers are properly maintained; (c) the returns required under the rules are sent to the Commissioner;

(iv) to note how far the defects pointed out at previous inspections have been removed and how far orders previously issued have been complied with; and (v) to point out all such defects or irregularities as he may have observed and to give orders for their rectification. - Percentage of Annual Income of Fund Towards Staff.- The Board shall ensure that the expenses of the staff including the staff employed for carrying out the programme of the Board and other administrative expenses shall not exceed ten per cent of the annual income of the Fund.

-

Publication of Annual Report of Board.- (1) The Board shall, within three months of

the date of closing of each financial year, submit to the Government an audited

statement of receipt and expenditure together with an annual report giving its

activities, in the year and the activities, if any, which are likely to be undertaken by

the Board in the next year.

(2) The statement and report shall be laid as soon as they are received by the Government before the Legislative Assembly.

(3) After the statement and report are laid before the Legislative Assembly, the Board shall cause the same to be published in such manner as it may deem fit. -

Maintenance of Registers by Employers.- (1) Every employer of an establishment

shall maintain the following registers, namely:-

(a) a register of wages in Form “B”, (b) a consolidated register of unpaid accumulation and fines and other deduction in Form “C”,

2. Added by S.R.O No.344/82 in K.G.No.11 dt.16-3-1982

(c) a visit book in which the Inspector visiting the establishment my record his remarks regarding any defect that may come to light at the time of inspection, which shall be produced whenever required to do so by the Inspector.

Provided that no separate register of wages in Form ‘B’ and no separate visit book need be maintained when the employer maintains such register of wages and visit book in compliance with the Payment of Wages Act, 1936 (Central Act 4 of 1936 or the Minimum Wages Act, 1948 (Central Act 11 of 1948) or the Kerala Shops Commercial Establishment Act, 1960 (34 of 1960). (2) The registers shall be preserved for a period of ten years from the date of last entry made therein.

NOTIFICATIONS

SRO 370/77:- In exercise of the powers conferred by sub-section (3) of Sl.1of the Kerala

Labour Welfare Fund Act 1975 (II of 1977), the Government of Kerala hereby appoint the 1 st

day of May, 1977, to be the date on which the said Act shall come into force in the whole of

the State of Kerala. [Published in Kerala Gazette Ex.No.263 dated.29-4-1977

G.O.MS.No.24/77/LBR dated.29-4-4977.]

SRO 370/77:- In exercise of the powers conferred by sub-section (1) of Sl.4 of the Kerala

Labour Welfare Fund Act 1975 (II of 1977), the Government of Kerala hereby establish a

Board by the Name, “Kerala Labour Welfare Fund Board”, with effect from the 1 st day of May

[Published in Kerala Gazette Ex.No.266 dated. 1 st May 1977 G.O.(Rt).No.528/77/LBR dated. 1 st

May 1977.]

SRO 550/82:- In exercise of the powers conferred by sub-section (1) of Sl.24 of the Kerala

Labour Welfare Fund Act 1975 (II of 1977), the Government of Kerala hereby appoint the

Assistant Labour Officers Grade II, the Assistant Labour Officer Grade I and the Inspectors of

Plantations of the Labour Department to be the Inspectors for the purposes of the said Act,

with their respective jurisdiction [G.O.(Rt)262/82/LBR dated 16-3-1982 published in Kerala

Gazette No.17 dated 27 th April 1982.

SRO 109/96:- In exercise of the powers conferred by sub-section (1) Section 24 of the Kerala

Labour Welfare Fund Act, 1975 (II of 1977), and in supersession of the Notification

No.G.O.(Rt) 1961/93/LBR dated 23 rd July, 1993 published as S.R.O.No.1336/93 in Kerala

Gazette Extraordinary No.32 dated 10 th August, 1993 the Government of Kerala hereby

appoint the officers mentioned in column (2) of the Schedule below to be Inspectors for the

purposes of the said Act in respect of all classes of establishment in the local limits

mentioned in column (3) thereof within which they shall exercise their functions, namely :-

[G.O.(Rt).No.250/96/LBR dt.23-1-1996.]

SCHEDULE

| SL.No. | Name and Designation of officers with Headquarters | Local Limits |

|---|---|---|

| (1) | (2) | (3) |

| 1 | Labour Welfare Fund Commissioner, Thiruvananthapuram | Whole State of Kerala |

| 2 | Labour Welfare Fund Inspector, Kollam | Revenue District of Thiruvanantha puram and Kollam |

| 3 | Labour Welfare Fund Inspector, Alappuzha | Revenue District of Alzppuzha and Pathanamthitta. |

| 4 | Labour Welfare Fund Inspector, Kottayam | Revenue District of kottayam and Idukki. |

| 5 | Labour Welfare Fund Inspector, Ernakulam | Revenue District of Ernakulam and Thrissur. |

| 6 | Labour Welfare Fund Inspector, Palakkad | Revenue District of Palakkad and Malappuram. |

| 7 | Labour Welfare Fund Inspector, Kozhikode | Revenue District of Kozhikode and Wayanad |

| 8 | Labour Welfare Fund Inspector, Kannur | Revenue District of Kannur and Kasaragod. |

NOTIFICATIONS

SRO 117/2005:- In exercise of the powers conferred by section 39 of the Kerala Labour

Welfare Fund Act 1975 (Act II of 1977), the Government of Kerala hereby exempt Kerala

Electricity Board from the provisions of the Kerala Labour Welfare Fund Act, 1975 (Act1977)

Explanatory Notes

(This does not form part of the notification, but is intended to indicate its general purpouse Government have decided to exempt Kerala State Electricity Board from the provision of Kerala Labour Welfare Fund Act, 1675 (Act II of 1977) as the Kerala State Electricity is having their own Welfare Fund which is seen more beneficial to its employees. This notification is intended to achieve the above object [G.O.Rt.No.102/2005/LBR.dt.Tvm,10-01-2005]

(This does not form part of the notification, but is intended to indicate its general purpouse Government have decided to exempt Kerala State Electricity Board from the provision of Kerala Labour Welfare Fund Act, 1675 (Act II of 1977) as the Kerala State Electricity is having their own Welfare Fund which is seen more beneficial to its employees. This notification is intended to achieve the above object [G.O.Rt.No.102/2005/LBR.dt.Tvm,10-01-2005]